Choosing a third party gold depository is a crucial decision. You need to make sure that you are not putting your savings at risk by using a provider that is not reputable. In addition, you need to make sure that you get the best value from your gold investments.

Allocated or Segregated Storage

Choosing the right storage type for your precious metals is essential. There are two main types of storage, segregated and allocated. The type you choose will affect the way you handle and store your metals. The two types are similar in many ways, but they differ in some important ways.

When bullion is housed in segregated storage, it is physically separated from the bullion of other clients and is examined, wrapped, labelled, and stored in high-security vaults. The cost of segregated storage is higher than the cost of non-segregated storage because segregated storage requires a large amount of manpower and space. Customers are guaranteed to get back the same identical bars or coins that they initially deposited, nevertheless.

Fungible bullion items, which are by nature interchangeable on the market, are examined and housed in high-security vaults with non-segregated storage. All bullion is fully accounted for and securely stored according to ongoing, independent audits and internal controls. Bullion is securely held in bulk, so customers that choose non-segregated storage enjoy significant cost savings.

Affordable Fees

Many depositories charge for the privilege of putting your gold in their vaults. If the price is right, you can have your gold stored for as long as you want. The cost of storage is a small price to pay for the peace of mind.

Depositories’ fees vary. Depending on the type of metal, you may pay a higher rate. The fees also depend on whether you opted for segregated or allocated storage.

For you to get an idea of how much depository fees can be, below is a sample taken from goldsilver.com.

SAMPLE FEES (SOURCE: goldsilver.com)

Seggregated fees: 0.08%/month, $35/mo. minimum per metal, per vault

Insurance

Whether you are storing gold or other precious metals in your home, you should always consider insurance. Adding insurance protection to your valuables can be costly. You may want to insure your gold with a third-party gold depository.

There are several reasons why you should consider insuring your gold. Your gold may be damaged or stolen. It can also be lost. You may also want to store your precious metals with a bank or a private depository. Depending on your needs, a private depository can provide you with the highest level of security.

Private non-bank vault depository services frequently provide comprehensive insurance for their clients’ holdings through reputable third party insurance companies, such Marsh & McLennan Companies or Lloyd’s of London, for instance.

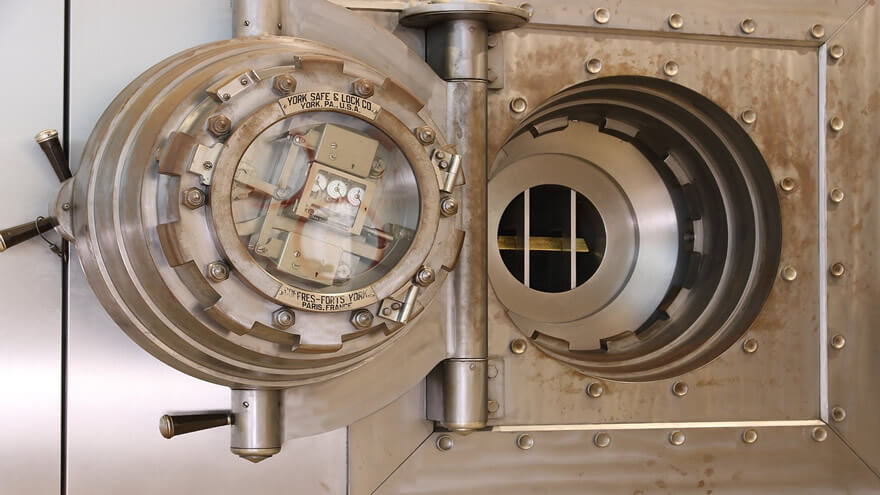

Security

Choose private depositories that offer 24-hour surveillance. They also offer alarm systems, biometric scanners, interlocking, redundant layers of electronic security and other features designed to ensure the safety of your precious metals. Depositories with very good security systems are usually approved by large global high-value insurers like AXA and Lloyd’s of London.